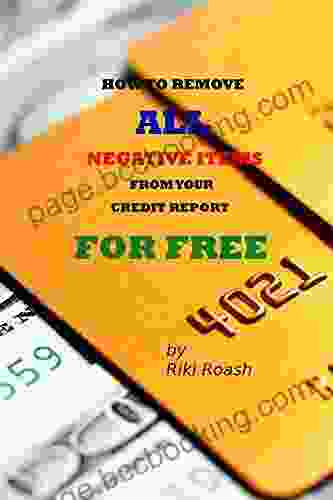

Unlock Your Financial Potential: The Ultimate DIY Guide to Dramatically Increase Your Credit Rating

In today's competitive financial landscape, a good credit rating is essential for securing loans, credit cards, and insurance at favorable terms. A low credit score can limit your financial opportunities, making it difficult to reach your financial goals. The good news is that you don't have to be a financial expert to improve your credit rating. With the right tools and strategies, you can take control of your financial destiny and dramatically increase your credit score.

4.4 out of 5

| Language | : | English |

| File size | : | 193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 63 pages |

| Lending | : | Enabled |

This comprehensive guide is your ultimate toolkit for credit repair and improvement. We will delve into the intricacies of credit scoring, provide practical steps to improve your credit profile, and empower you with the knowledge to make informed financial decisions. By following the expert advice and proven techniques outlined in this guide, you will unlock the secrets to financial freedom and achieve your dreams.

Chapter 1: Understanding Your Credit Score

The foundation of credit repair lies in understanding how your credit score is calculated. We will explore the different credit scoring models, including FICO and VantageScore, and break down the key factors that impact your score. By gaining a clear understanding of credit scoring, you will be equipped to identify areas for improvement and develop targeted strategies to enhance your overall credit profile.

Key Takeaways:

- Identify the different credit scoring models and their components.

- Understand the factors that positively and negatively impact your credit score.

- Learn how to access and interpret your free credit reports.

Chapter 2: Dispute and Correct Errors

Credit reports can contain errors that can damage your credit score. This chapter provides a step-by-step process for disputing and correcting inaccurate or outdated information on your credit reports. You will learn how to identify common errors, gather supporting documentation, and submit formal disputes to credit bureaus. By effectively challenging and correcting errors, you can significantly improve your credit score.

Key Takeaways:

- Identify and understand common credit report errors.

- Learn the proper procedures for disputing and correcting errors.

- Develop strategies for effectively communicating with credit bureaus.

Chapter 3: Manage Debt Responsibly

Managing debt is crucial for maintaining a healthy credit score. This chapter provides practical advice on how to reduce your debt load, lower your credit utilization ratio, and avoid common debt traps. You will learn about different debt repayment strategies, such as debt consolidation and debt settlement, and explore options for managing student loans and medical debt. By implementing effective debt management techniques, you can free up credit, improve your cash flow, and significantly boost your credit score.

Key Takeaways:

- Understand how different types of debt impact your credit score.

- Learn about debt repayment strategies and choose the best option for your situation.

- Discover ways to reduce your credit utilization ratio and improve your debt-to-income ratio.

Chapter 4: Build Positive Credit History

Establishing and maintaining a positive credit history is essential for building a strong credit score. This chapter discusses various methods for building credit, including obtaining secured credit cards, becoming an authorized user on someone else's account, and taking out small loans for responsible purposes. You will learn how to use credit wisely and avoid common mistakes that can damage your credit history. By consistently making on-time payments and demonstrating responsible credit use, you can establish a solid credit foundation.

Key Takeaways:

- Explore different options for building credit, including secured cards and authorized user accounts.

- Learn how to use credit wisely and avoid overspending and late payments.

- Understand the importance of positive credit history for long-term financial success.

Chapter 5: Monitor and Protect Your Credit

Once you have improved your credit score, it is crucial to monitor your credit regularly to detect any potential issues and protect your financial identity. This chapter covers the importance of credit monitoring, fraud prevention, and identity theft protection. You will learn how to set up credit alerts, freeze your credit, and report fraudulent activity. By actively monitoring your credit, you can stay ahead of potential problems and safeguard your financial well-being.

Key Takeaways:

- Understand the benefits and importance of credit monitoring.

- Learn about different fraud prevention and identity theft protection measures.

- Develop strategies for protecting your financial information and avoiding identity theft.

: Achieving Financial Freedom

Improving your credit score is not an overnight process, but with consistent effort and the strategies outlined in this guide, you can dramatically increase your credit rating and unlock a world of financial opportunities. By understanding your credit score, disputing errors, managing debt responsibly, building positive credit history, and monitoring your credit, you will be empowered to take control of your financial future. Embrace the knowledge and tools provided in this guide, and embark on a journey towards financial freedom and success.

Call to Action:

Invest in your financial well-being today! Free Download your copy of the "Do It Yourself Guide to Dramatically Increase Your Credit Rating" now and unlock the secrets to financial freedom. Let us guide you on the path to improving your credit score, achieving your financial goals, and living the life you deserve.

Free Download Now

4.4 out of 5

| Language | : | English |

| File size | : | 193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 63 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Sean Julie

Sean Julie Richard Sayette

Richard Sayette Ron Elbe

Ron Elbe Renata Adler

Renata Adler Tony Rose

Tony Rose Pat Drake

Pat Drake Rachel Dodman

Rachel Dodman Patty Lennox

Patty Lennox Peter Mayle

Peter Mayle Phil C Senior

Phil C Senior Paul Chapman

Paul Chapman Tara D Ramsey

Tara D Ramsey Wendy Mogel

Wendy Mogel Stephanie Vandrick

Stephanie Vandrick Steve Jamison

Steve Jamison Stanley Schmidt

Stanley Schmidt Sarah Stein Greenberg

Sarah Stein Greenberg Philippa Perry

Philippa Perry Nigel Palmer

Nigel Palmer Nicole Kornher Stace

Nicole Kornher Stace

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Thomas PowellBirthdays Beyond Cake And Ice Cream: Unlocking the Hidden Meaning of Your...

Thomas PowellBirthdays Beyond Cake And Ice Cream: Unlocking the Hidden Meaning of Your... Lawrence BellFollow ·11.2k

Lawrence BellFollow ·11.2k Grant HayesFollow ·15.6k

Grant HayesFollow ·15.6k Chad PriceFollow ·18.6k

Chad PriceFollow ·18.6k Eugene PowellFollow ·17.6k

Eugene PowellFollow ·17.6k Jack PowellFollow ·3.6k

Jack PowellFollow ·3.6k Jeff FosterFollow ·16.6k

Jeff FosterFollow ·16.6k Ian MitchellFollow ·6.4k

Ian MitchellFollow ·6.4k Duncan CoxFollow ·10.7k

Duncan CoxFollow ·10.7k

Marvin Hayes

Marvin HayesGoverning Law for Law School and Bar Exam Prep: Your...

Unlock the Secrets of...

Sidney Cox

Sidney CoxUnveiling the Epic Tales of Whiskey, War, and Military...

In the tapestry of history,...

Victor Turner

Victor TurnerGoverning Law for Law School and Bar Exam Prep: The...

What is Governing...

Robert Browning

Robert BrowningSterling Test Prep MCAT General Chemistry Practice...

: Embark on Your MCAT General Chemistry...

4.4 out of 5

| Language | : | English |

| File size | : | 193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 63 pages |

| Lending | : | Enabled |