Central Banks at Crossroads: Navigating Uncharted Monetary Territory

Central banks are facing a crossroads. The traditional tools of monetary policy, such as interest rates and quantitative easing, are becoming less effective in an era of low inflation and low growth. At the same time, new challenges are emerging, such as the rise of cryptocurrency and the increasing interconnectedness of the global financial system.

4.4 out of 5

| Language | : | English |

| File size | : | 6364 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 717 pages |

In this book, we explore the challenges and opportunities facing central banks as they navigate this uncharted monetary territory. We provide in-depth analysis of the latest monetary policy frameworks and case studies from around the world. We also discuss the implications of new technologies, such as cryptocurrency and blockchain, for the future of money and banking.

Challenges Facing Central Banks

Central banks are facing a number of challenges, including:

- Low inflation: Inflation has been stubbornly low in many advanced economies for over a decade. This has made it difficult for central banks to raise interest rates, which is the traditional tool for fighting inflation.

- Low growth: Economic growth has also been weak in many advanced economies. This has made it difficult for central banks to lower interest rates, which is the traditional tool for stimulating growth.

- High debt: Governments and households have accumulated a lot of debt in recent years. This makes it difficult for central banks to raise interest rates, which could lead to a debt crisis.

- Financial instability: The global financial system is becoming increasingly interconnected. This makes it more vulnerable to shocks, such as the 2008 financial crisis.

- Climate change: Climate change is posing new challenges for central banks. They need to find ways to support the transition to a low-carbon economy without causing financial instability.

Opportunities for Central Banks

Despite the challenges, central banks also have a number of opportunities, including:

- New technologies: New technologies, such as cryptocurrency and blockchain, could help central banks to improve the efficiency of the financial system and make it more inclusive.

- Greater cooperation: Central banks are increasingly cooperating with each other. This can help them to coordinate their monetary policies and avoid financial crises.

- Increased transparency: Central banks are becoming more transparent about their operations. This can help to build trust and confidence in the financial system.

The Future of Monetary Policy

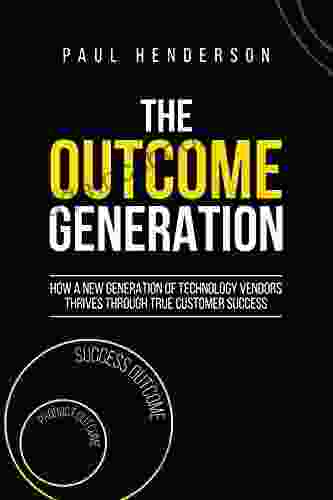

The future of monetary policy is uncertain. Central banks are facing a number of challenges, but they also have a number of opportunities. The path that they choose will have a major impact on the global economy.

In this book, we provide a roadmap for the future of monetary policy. We discuss the challenges and opportunities facing central banks, and we propose a number of reforms that could help them to navigate this uncharted territory.

Central banks are at a crossroads. They need to find new ways to manage inflation, growth, and financial stability in an era of low inflation and low growth. They also need to address the challenges posed by new technologies, such as cryptocurrency and blockchain. The future of monetary policy is uncertain, but the choices that central banks make will have a major impact on the global economy.

This book provides a roadmap for the future of monetary policy. It is a must-read for policymakers, financial professionals, and anyone interested in the future of money and banking.

4.4 out of 5

| Language | : | English |

| File size | : | 6364 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 717 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Walter Jon Williams

Walter Jon Williams Peter N Peregrine

Peter N Peregrine Tommaso Astarita

Tommaso Astarita Peter B Gillis

Peter B Gillis Zanna Goldhawk

Zanna Goldhawk Philip Jackson

Philip Jackson Sarah Stein Greenberg

Sarah Stein Greenberg Robert I Sutton

Robert I Sutton Pepper North

Pepper North Paul Halpern

Paul Halpern T A Hyman

T A Hyman Teju Cole

Teju Cole Swaminathan Sankaran

Swaminathan Sankaran Peter Raby

Peter Raby Michelle Knight

Michelle Knight Peg Heron Heidel

Peg Heron Heidel Paul D Leedy

Paul D Leedy Melissa J Homestead

Melissa J Homestead Robert Gerver

Robert Gerver Patrick Garrett

Patrick Garrett

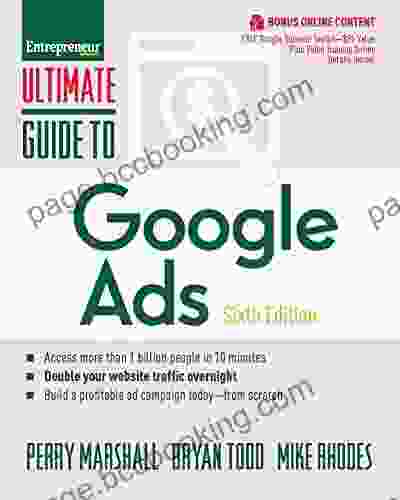

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Aaron BrooksThe Ultimate Survival Guide to Parenting Adult Children: Empowering Parents...

Aaron BrooksThe Ultimate Survival Guide to Parenting Adult Children: Empowering Parents... Roger TurnerFollow ·14.9k

Roger TurnerFollow ·14.9k Robert FrostFollow ·17.2k

Robert FrostFollow ·17.2k Mason PowellFollow ·6.5k

Mason PowellFollow ·6.5k Howard PowellFollow ·14.3k

Howard PowellFollow ·14.3k David Foster WallaceFollow ·15.1k

David Foster WallaceFollow ·15.1k Henry David ThoreauFollow ·12.3k

Henry David ThoreauFollow ·12.3k Aubrey BlairFollow ·5k

Aubrey BlairFollow ·5k Ian PowellFollow ·15.7k

Ian PowellFollow ·15.7k

Marvin Hayes

Marvin HayesGoverning Law for Law School and Bar Exam Prep: Your...

Unlock the Secrets of...

Sidney Cox

Sidney CoxUnveiling the Epic Tales of Whiskey, War, and Military...

In the tapestry of history,...

Victor Turner

Victor TurnerGoverning Law for Law School and Bar Exam Prep: The...

What is Governing...

Robert Browning

Robert BrowningSterling Test Prep MCAT General Chemistry Practice...

: Embark on Your MCAT General Chemistry...

4.4 out of 5

| Language | : | English |

| File size | : | 6364 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 717 pages |